"Art is often seen as a store of value, but actually any art-seller would tell you that ahead of a sale they never know if they will be able to obtain the price they want for an artwork or if they will be able to sell the artwork at all."

Image: Christine Bourron , the Founder of Pi-eX Ltd, courtesy to Pi-eX Ltd

ArtDependence Magazine, Etienne Verbist (AD): Who are you, and why do you do what you do?

Christine Bourron (CB): I am the founder and CEO of Pi-eX Ltd, a London-based broker dealer. Pi-eX 's mission is to help art collectors and investors better manage liquidity, risk and volatility by providing analytical and financial tools especially designed for the fine-art market.

My background is finance and technology. My involvement with the art market dates back from the end of the 1990s when I created the first online art gallery in New York. At the time, I was fascinated by the new possibilities presented by emerging internet technologies, which I discovered in 1995. I was looking for business opportunities leveraging the power of the internet, and my personal experience of buying original art made it obvious to me that the internet could dramatically improve the way art was sold to collectors. Therefore, in 1997 I decided to launch Paintingsdirect.com, which at the time was the first online art gallery. By the year 2000, Paintingsdirect was representing more than 500 contemporary artists and we were selling their original artworks worldwide via our online platform.

This early experience allowed me to better appreciate the shortcomings of the art market and put me on a trajectory to improve the fine art market by helping it to grow.

As a finance person, I was always reserved to regard art as an investment. My biggest issues when seeing art as an investment were:

the limited dataavailable, the absence of systematic and transparent tracking mechanisms, and the inability to hedge one’s financial risk when investing in such high-ticket items with low liquidity.

As I could see however, that more and more people were interested in the concept of art as an investment, I decided back in 2014, to create new analytical and financial tools to help address these issues.

AD: What’s your mission?

CB: My ultimate goal is to help grow the art market, making it possible for more original art to be bought and sold, and a wider audience enjoying art.

AD: Why does it make sense for those interested in investing in the fine art market to have financial instruments based on fine art? Why do financial instruments make sense in general?

CB: Of course people initially see financial instruments as a way for investors to take a financial, non-tangible position on an asset; Stocks for example, are ways for investors to invest in the future growth of a company, and real-estate loans are a way for investors to get an indirect share from the revenue generated by properties.

These financial instruments are of great value to investors because they allow them to take a small position in various assets without having to own the whole asset, which would be riskier and obviously more cash intensive.

What people often forget to consider is the fact that financial instruments also play a very important role for the owners of the assets on which they are based; Stocks are a way in which the owners of a company obtain capital in order to finance their growth plan. The money that is issued through the stock issuance is invested according to the growth plan that was presented to investors. Similarly, a loan obtained in real-estate could be used to purchase or improve a building, helping to generate new revenue from the rental or sale of the property and therefore justifying the additional interest payments that the loan involves. It is because financial instruments play these important economic roles that they are justified, rather than simply because they allow investors to invest.

I believe that in a similar way, financial instruments can play an important role in the economy of the fine art market.

AD: What kind of financial instrument makes sense for the fine art market?

CB: To understand the type of financial instrument that makes sense in the fine art market, you have to understand; the kinds of problems the fine art market needs help to solve and how a financial instrument could solve them.

When looking at the fine art market one sees a long list of problems likeliquidity issue, big ticket item, volatility etc.

Mapping this with financial instruments, and looking at the types of issues that financial instruments can help solve while making sure that the investment makes sense for the investors, is what will tell you the kind of financial instrument that makes sense for the fine art market.

While fractional ownershipis often presented as a solution for the liquidity and big ticket item issues of the fine art market, I actually do not think this is the right financial instrument because it does not make sense for the investors.

As mentioned in the previous question, stocks are a solution when someone has a business project with great growth potential but little cash available. The owner of the project needs funding to go ahead with his or her project and issuing stocks is a way to obtain this funding with the agreement that the value created will be shared with the new shareholders.

This is the basis of stock issuance that people often forget in the case of art. If someone were to issue stock on a painting, then what would they do with the money raised? Would it be used to increase the value of the artwork (can it be used to increase the value of an artwork?) or would it be just given to the previous owner of the artwork for him or her to use as they wish? This is a very important question that any investor interested in buying a share of an artwork should ask because this is going to affect the future value of his or her stock. Short term there may be some speculative trading that would increase the stock price, but long term it is very unlikely that the stock price continues to increase if there is no value created to justify the growth.

So to answer your question, the financial instrument that makes sense for the fine art market is an instrument that will work both for the art owner and the investor.

AD: What role can financial instruments play in the fine art market?

CB: Based on Pi-eX‘s in-depth analysis of the art market, we believe that one of the biggest issuesthe art market is facing, and the one that a financial instrument could solve, is volatility.

Art is often seen as a store of value, but actually any art-seller would tell you that ahead of a sale they never know if they will be able to obtain the price they want for an artwork or if they will be able to sell the artwork at all.

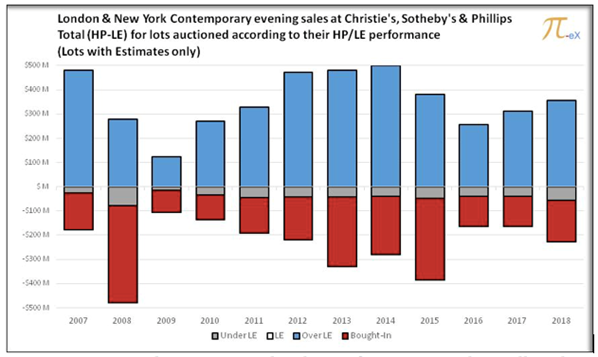

Here below you can see a standard graph from Pi-eXanalysis of all impressionist and contemporary lots sold at repeating evening sales at Christie’s, Sotheby’s and Phillips since 2007.

Pi-eX Ltd proprietary database of auction results – All Rights Reserved

Particularly in this chart you can see the difference between what art sellers wanted for the artworks they offered at auction houses (the Low Estimate or LE), and the price at which the artwork was hammered (the Hammer Price or HP).

The value above the Low Estimate is in blue; in gray is the value below the Low Estimate and in red is the value of all the artworks that did not sell. With this definition, you can see the blue bars as a proxy for the level of happiness in the auction room and the red bars as a proxy for the level of unhappiness. Volatility is obvious on this graph: Firstly, volatility across the time period, with some good years like 2012, 2013 and 2014 and some bad years like 2008 and 2009. Secondly, volatility is present even during the good years as we can see both long blue and red bars in 2013, 2014 and 2015, meaning that there were both happy and unhappy sellers in these top performing years.

By providing the art market with a financial instrument that allows art sellers to insure themselves against this volatility/financial risk, I believe that we will help increase the liquidity and thus the growth of the fine art market.

AD: What will be the impact of your platform?

CB: First I would like to make it very clear that we do not sell any financial instruments on our platform. Pi-eX’s financial instruments are regulated instruments and as derivative products they are not available to the retail market. Our target market are certified high-net worth and sophisticated investors, professional clients and eligible counter parties.

What we have available on the Pi-eXplatform is all the research and analysis that we do about the fine art market. Analysis and investment go hand in hand, and because our financial instruments are based on existing artworks, we continuously track and analyse all sales at Christie’s, Sotheby’s and Phillips in the most transparent way possible.

I believe the impact of making transparent information available will be that more people will seize the opportunity to buy and sell art.

AD: What are the functions of the platform?

CB: Pi-eX's platform’s ultimate goal is to make data and analysis easily accessible to all.

We achieve this by providing multiple standard reports about art sales in a very accessible way and at very reasonable prices.

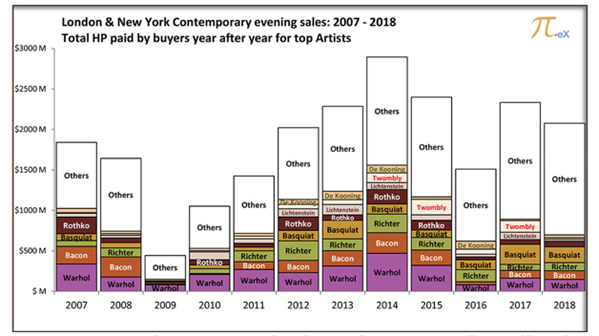

Let’s say for example that you want to know which contemporary artists have been selling consistently over the past 12 years at Christie’s, Sotheby’s and Phillips evening sales in London and New York; you can find this information on Pi-eX.

Pi-eX Ltd proprietary database of auction results – All Rights Reserved

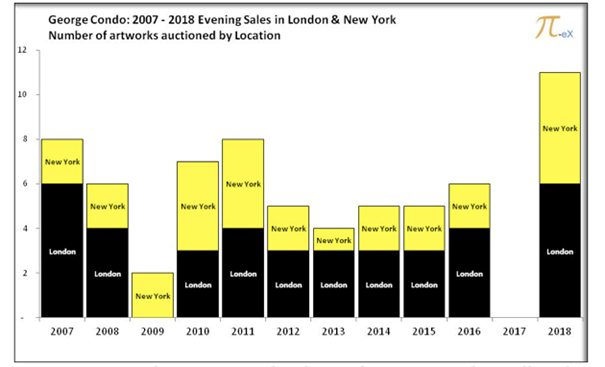

Or you are wondering whether you can buy a George Condo’s artwork at evening auction sales in New York or in London, Pi-eX can help you find the answer:

Pi-eX Ltd proprietary database of auction results – All Rights Reserved

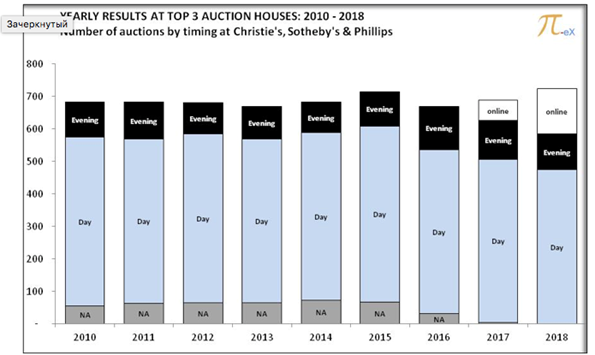

Or you may be interested in knowing how many evening auctions versus day auctions take place every year at Christie’s Sotheby’s and Phillips.

Pi-eX Ltd proprietary database of auction results – All Rights Reserved

If you want to know how much has been sold at day auctions versus evening auctions, this is also available on Pi-eX. You can even find out the average price in US$ or GBP of lots sold at evening auctions versus lots sold at day auctions. On Pi-eXplatform, those interested in learning more about the latest art trends can find all the information they need. They may also always compare what happened recently versus historical results.

AD: What makes the platform disruptive?

CB: There are four main aspects of our online data analysis platform that make us disruptive:

Our unique database:

Any analysis is only as good as the data on which it is based. At Pi-eXwe take extreme measures to make sure that our data is clean, which means standardized, reliable and most importantly exhaustive.

Our standard methodology:

Analysing auctions and fine art sales can be a challenge because of the small size of the dataset. Here we do not have a big-data challenge but rather a small-data challenge. If you have only 3 data points that reflect the historical sales of an artwork, how can you analyse this? Surely it will be difficult to do a regression analysis with the three points. To address this challenge we have developed a new methodology specific for the fine art market.

Our Analytical Reports:

Pi-eX’s reports are short visual and standardised reports with the goal to answer specific and practical questions.

Pricing:

Our pricing is very affordable as Pi-eX’s ultimate goal is to increase transparency and allow as many people as possible to educate themselves on the art market

AD: What Is the Future of Art?

CB: I believe that the future of Art is very bright! In my now more than 25 years career I have never encountered an industry that generates as much enthusiasm as the world of art. People can be passionate about many products from watches to phones, computers to bags but no product has the ability to continuously surprise us and raise questions like art.

AD: Tell about the art market please.

CB: The art market has been very protected and closed for many years. Some people think it is a good thing and that the market should stay self-regulated and a world of insiders. I personally think that it is only by opening itself and becoming more transparent that the art market will finally grow.

AD: What is your dream project?

CB: Pi-eX. I love what I do!

AD: What role does the artist have in society?

CB: Artists play a very important role in society. Through their artworks they communicate the world in which we – human beings – live. Whether it is with a peaceful landscape by Monet, a portrait of Marilyn Monroe by Andy Warhol, a balloon dog sculpture of Jeff Koons, The Holy Virgin Mary with a lump of elephant dung by Chris Ofili, Still Life with a Yellow Potby Jacques Flacher or Dataflagson Somerset paper screen print, with data from Lehman Brothers’ financial trading history by Fabio Lattanzi Antinori, all these artworks reflect the world in which we humans have lived, are living or will live in.

“Still Life with a Yellow Pot” (1998), by Jacques

I believe that artists are our memory and our conscience.

AD: What memorable responses have you had to your projects?

CB: At the time when we were building our clean proprietary database and developing our standard analytical method, I remember meeting with an art dealer and showing him one of our artists’ reports.

He looked at it carefully and after a pause gave it back to me and said in a somehow unfriendly manner “You are not teaching me anything. I know all this. ”This was my “Eureka!” moment as I understood that our report was doing exactly what we wanted: leveraging data to provide art market relevant information to those who may not be insiders to the fine art world.

AD: What do you dislike about the art world?

CB: I dislike the fact that its lack of transparency and insiders’ dealings prevents the whole market to grow. I know so many people who would love to buy art but do not, because they feel as unwelcome outsiders. At the same time there are so many artists who have such interesting art to sell to the world but do not because the market is too small.

AD:What role does art funding have?

CB: Given the current dynamic of the art market (see question above), art funding certainly plays a very important role in supporting the many artists and art institutions who may be unable to finance their art creation and operations.

AD: What research do you do?

CB: We continuously monitor the fine art market, tracking auction sales at Christie’s, Sotheby’s and Phillips and artists’ performances. We also continue to develop new analytical tools to better share the trends we see in the fine art market.

AD: Could you tell us more about what would you be discussing about at the 2nd Annual UNFOLD Art XChange?

CB: At the UNFOLD ArtXchange conference I intend to discuss data and data analysis in the fine art market, especially the importance of clean data and a standardised approach to analysis.

AD: Which technologies do you use & combine & why?

CB: Internet technology: to reach a wide audience

AA (Automated algorithms) technology: to standardize our reports

Blockchain technology: to improve the efficiency of the clearing of our financial instrument

ArtDependence Magazine is an international magazine covering all spheres of contemporary art, as well as modern and classical art.

ArtDependence features the latest art news, highlighting interviews with today’s most influential artists, galleries, curators, collectors, fair directors and individuals at the axis of the arts.

The magazine also covers series of articles and reviews on critical art events, new publications and other foremost happenings in the art world.

If you would like to submit events or editorial content to ArtDependence Magazine, please feel free to reach the magazine via the contact page.